FEMA is updating the National Flood Insurance Program's (NFIP) risk rating methodology through the implementation of a new pricing methodology called Risk Rating 2.0. The methodology leverages industry best practices and cutting-edge technology to enable FEMA to deliver rates that are actuarily sound, equitable, easier to understand and better reflect a property’s flood risk.

Read the press release: FEMA Updates Its Flood Insurance Rating Methodology to Deliver More Equitable Pricing

FEMA is conscious of the far-reaching economic impacts COVID-19 has had on the nation and existing policyholders and is taking a phased approach to rolling out the new rates.

Current National Flood Insurance Program policyholders can contact their insurance company or insurance agent to learn more about what Risk Rating 2.0-Equity in Action means to them.

Phase I

Beginning Oct. 1, 2021, new policies were subject to the new rating methodology. Also beginning Oct. 1, existing policyholders eligible for renewal were able to begin taking advantage of immediate decreases in their premiums.

Phase II

All remaining policies renewing on or after April 1, 2022, are subject to the new rating methodology.

FEMA continues to engage with Congress, its industry partners and state, local, tribal and territorial agencies to ensure clear understanding of these changes.

Why FEMA is Undertaking Risk Rating 2.0

FEMA is committed to building a culture of preparedness across the nation. Purchasing flood insurance is the first line of defense against flood damage and a step toward a quicker recovery following a flood.

Since the 1970s, rates have been predominantly based on relatively static measurements, emphasizing a property’s elevation within a zone on a Flood Insurance Rate Map (FIRM).

This approach does not incorporate as many flooding variables as Risk Rating 2.0. Risk Rating 2.0 is not just a minor improvement, but a transformational leap forward. Risk Rating 2.0 enables FEMA to set rates that are fairer and ensures rate increases and decreases are both equitable.

FEMA is building on years of investment in flood hazard information by incorporating private sector data sets, catastrophe models and evolving actuarial science.

With Risk Rating 2.0, FEMA now has the capability and tools to address rating disparities by incorporating more flood risk variables. These include flood frequency, multiple flood types—river overflow, storm surge, coastal erosion and heavy rainfall—and distance to a water source along with property characteristics such as elevation and the cost to rebuild.

Currently, policyholders with lower-valued homes are paying more than their share of the risk while policyholders with higher-valued homes are paying less than their share of the risk. Because Risk Rating 2.0 considers rebuilding costs, FEMA can equitably distribute premiums across all policyholders based on home value and a property’s unique flood risk.

What’s Not Changing Under Risk Rating 2.0

We are upholding statutory requirements by:

Limiting Annual Premium Increases

Existing statutory limits on rate increases require that most rates not increase more than 18% per year.

Using Flood Insurance Rate Maps (FIRMs) for Mandatory Purchase and Floodplain Management

FEMA’s flood map data informs the catastrophe models used in the development of rates under Risk Rating 2.0. That is why critical flood mapping data is necessary and essential for communities. It informs floodplain management building requirements and the mandatory purchase requirement.

Maintaining Features

We are maintaining features to simplify the transition to Risk Rating 2.0 by offering premium discounts to eligible policyholders. This means:

- FEMA is continuing to offer premium discounts for pre-FIRM subsidized and newly mapped properties.

- Policyholders are still able to transfer their discount to a new owner by assigning their flood insurance policy when their property changes ownership.

- And discounts to policyholders in communities who participate in the Community Rating System will continue. Communities can continue earning National Flood Insurance Program rate discounts of 5% - 45% based on the Community Rating System classification. However, since Risk Rating 2.0 does not use flood zones to determine flood risk, the discount will be uniformly applied to all policies throughout the participating community, regardless of whether the structure is inside or outside of the Special Flood Hazard Area.

Documents and Resources

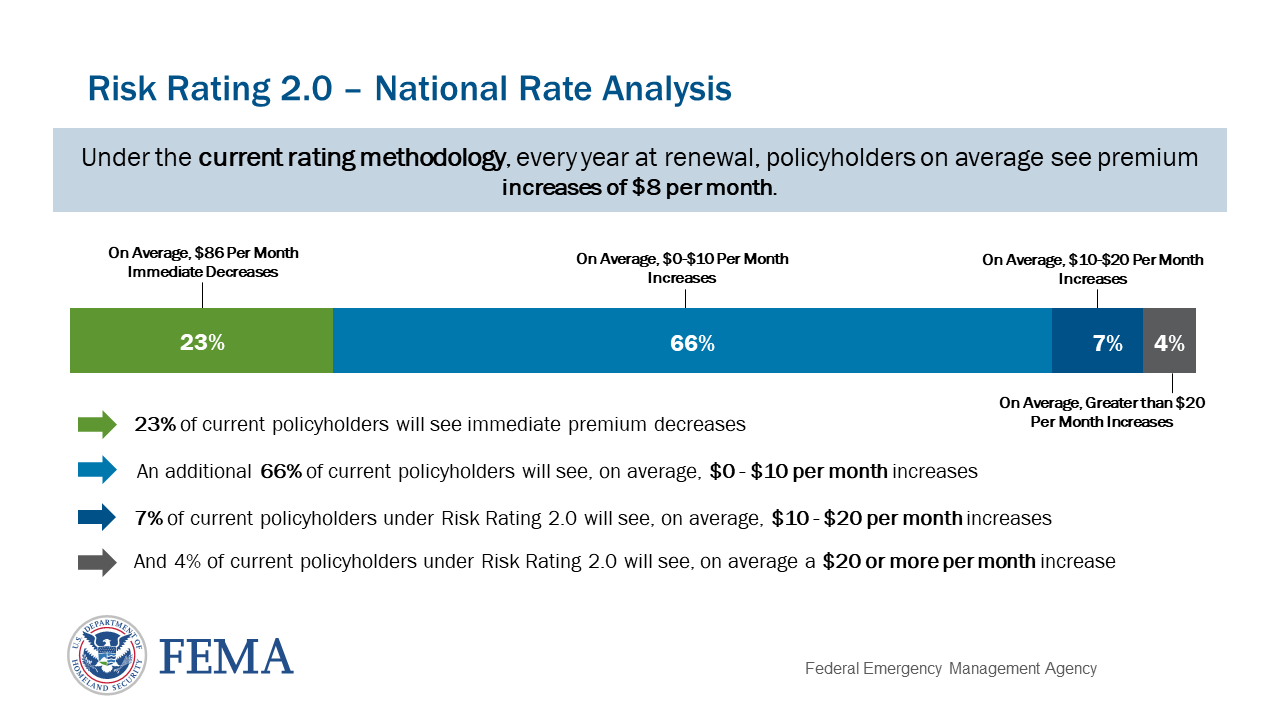

Infographic: National Rate Analysis

Release Date: April 2021

State Profiles

View the collection of 50 state profiles, which contain data specific to each state.

View State Profiles

Technical Documents

- Risk Rating 2.0 Methodology and Data Sources

- Risk Rating 2.0 Methodology and Data Sources - Premium Calculation Worksheet Examples

- Risk Rating 2.0 Methodology and Data Sources - Appendix D Rating Factors

- Levees in Risk Rating 2.0

- Discount Explanation Guide

- Rate Explanation Guide

More Information

Customers: To learn more about the value of flood insurance, please speak with your agent, insurance provider or visit Flood Smart.

Agents: Learn more about Risk Rating 2.0: Equity in Action. Information includes answers to frequently asked questions and shareable marketing resources to help your clients understand their property’s unique flood risk.

Have questions? Please send us an email.